Our Top Free Resource

This comprehensive estate planning kit helps you protect your family and establish your legacy. FREE!

Download our FREE Personal Estate Planning KitGift and Estate Planning

In 1923, Santa Rita No. 1 struck oil on university lands, generating a rich source of funding for Texas education. Photo: Courtesy of Dolph Briscoe Center for American History

Did The University of Texas at Austin help expand your horizons, leading you to become the person you are today? You have the power to create the same opportunities and enrich the lives of future Longhorns by donating an asset you may not have considered before — land and minerals.

Gifts of land and mineral interests are long-term investments in the University's continuing progress and constant improvement. You may never have considered this, but you can create an endowment — or many different endowments — to advance programs that are most meaningful to you.

Maybe you want to help students who struggle to attend college. Maybe you want to help create new hands-on experiences and research opportunities for students. Or maybe you want to help revolutionize how disciplines come together to solve the world's toughest problems.

However you choose to direct your donation, your support enhances the University's excellence and helps us remain one of the most powerful centers of learning, research, and creativity. Who knows? Your gift could be the support needed to make the next world-changing discovery possible.

Like you, the State of Texas recognizes the importance of education and the need to invest in its long-term growth and advancement. University Lands, an organization of the UT System, has been stewarding the largest land and minerals endowment in the country for over 100 years. The employees of University Lands hold the Lone Star State's natural assets near and dear, and today this team of experts oversees holdings not just in Texas but also in 21 additional states and Canada that were entrusted to University Lands by generous donors like you.

From oil and gas royalties to lease payments and grazing fees, the University Lands office is among the nation's most reliable and experienced managers of natural resources. You can feel secure knowing that professionals with several hundred years of combined oil and gas expertise will manage your land or mineral interests responsibly while maximizing their impact for The University of Texas at Austin.

Let us help you explore the possibilities. These are just some of the resources you might consider putting to work for the University now or in the future through your estate:

Together, you and University Lands are a mighty combination. Let us work with you to achieve your philanthropic goals and benefit what you love most at your alma mater — now and far into the future.

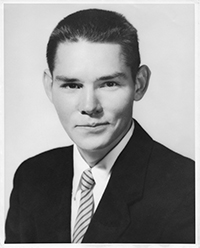

T.W. "Tom" Whaley, PhD '68

T.W. "Tom" Whaley, an orphan until age 15, always knew education was the key to his future. Despite a rough start in life, he went on to earn a doctorate in electrical engineering at UT in 1968, and his expertise led to a remarkable career in the CIA. He later returned to his family's farm and developed the land into productive real estate.

Before his death in 2013, Whaley made plans to leave his assets, including more than 700 mineral interests in 10 states, to the school he felt inspired his path to success. Producing mineral income that ranges from six to seven figures annually, this gift instantly grew the Cockrell School of Engineering's scholarship program by more than 25 percent.

With continued management by the University Lands organization, Whaley's legacy is passing the key to education on to future generations of UT students.

This comprehensive estate planning kit helps you protect your family and establish your legacy. FREE!

Download our FREE Personal Estate Planning Kit

These important assets can help benefit you and future Longhorns.

Get My Guide

This comprehensive estate planning kit helps you protect your family and establish your legacy. FREE!

Download our FREE Personal Estate Planning Kit